child tax credit monthly payments continue in 2022

Instead the expanded Child Tax Credit payments expired at the end of 2021. These taxpayers must file a 2022 Indiana resident tax return to claim the 200 before January 1 2024.

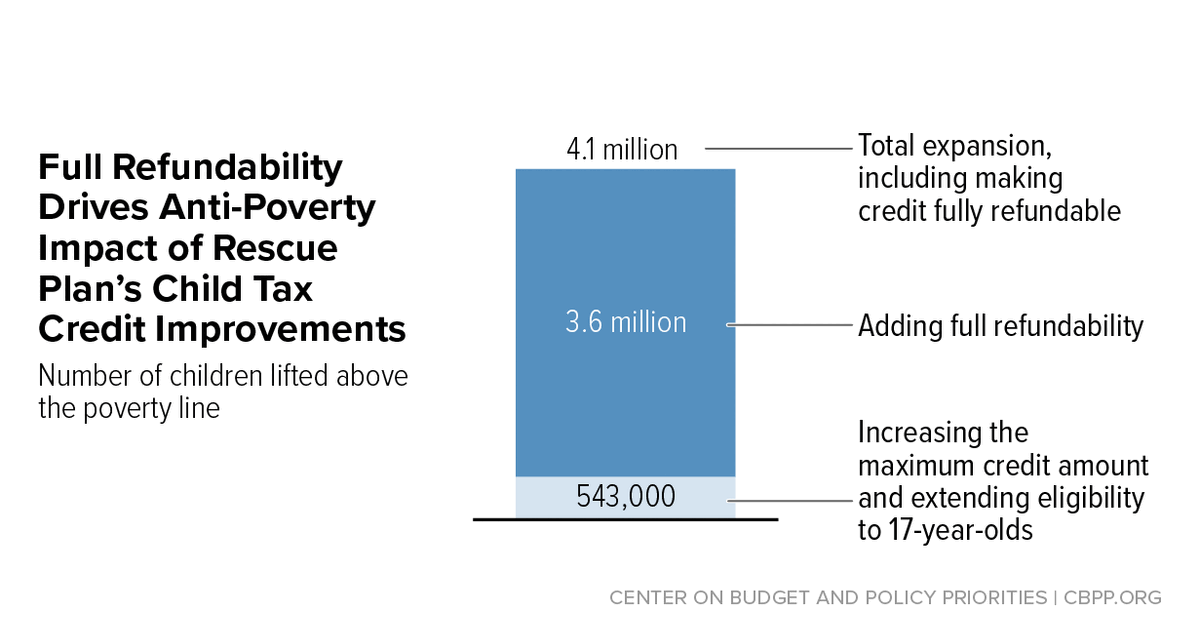

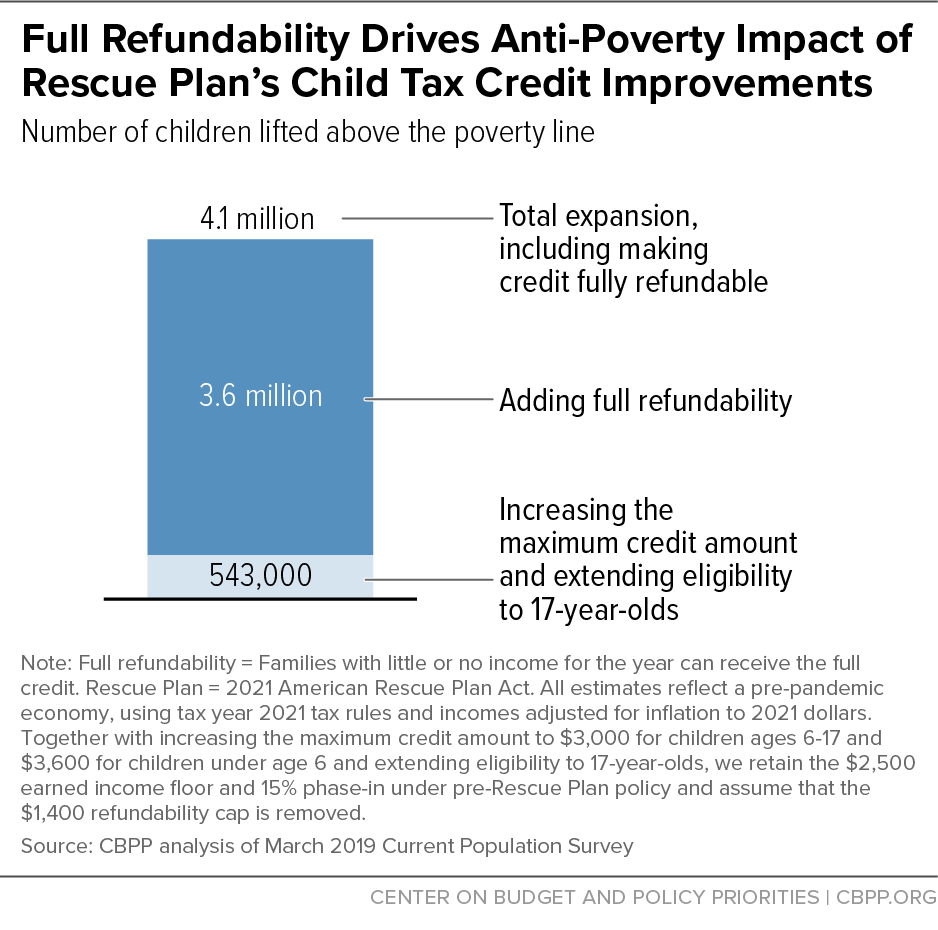

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

As of January there were more than 27 million SNAP recipients throughout the state a 73.

. Those returns would have information like income filing status and how many children are. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Half of the enhanced sum was made. Rhode Island residents can similarly claim 250 per child and up to 750 for three children in a new initiative that has started this month. The existing credit of 2000 per child under age 17 was increased to 3600 per child under 6 and 3000 per child ages 6 through 17.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

As part of the federal governments pandemic response the 2021 expansion of the Child Tax Credit increased the amount of the credit made more families eligible for the tax credit and. Continuing the expanded credit would have eased the effects of inflation on families. Struggling New Yorkers continue to rely heavily on SNAP as the COVID-19 pandemic continues.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The Empire child tax credit in New.

The advance child tax credit payments were based on 2019 or 2020 tax returns on file. However rather than a direct payment- it will be a 200 tax credit toward taxes or refund.

Federal Stimulus Update Will Child Tax Credit Monthly Payments Restart

Parents Struggle After Monthly Child Tax Credit Payments End

About The 2021 Expanded Child Tax Credit Payment Program

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

Child Tax Credit Will There Be Another Check In April 2022 Marca

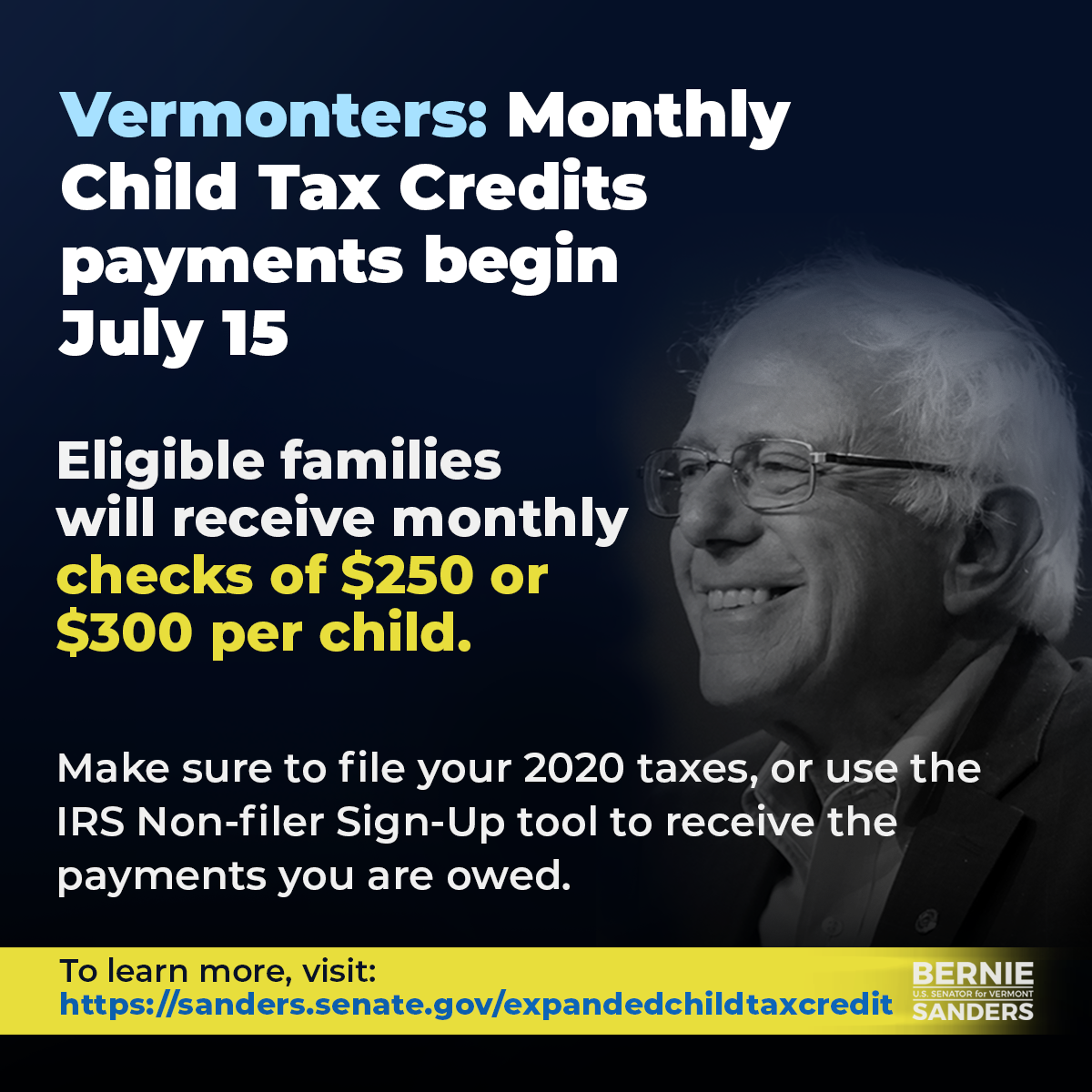

Expanded Child Tax Credit Senator Bernie Sanders

Stimulus Update Final Child Tax Credit Payment Of The Year Arrives In 1 Week

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

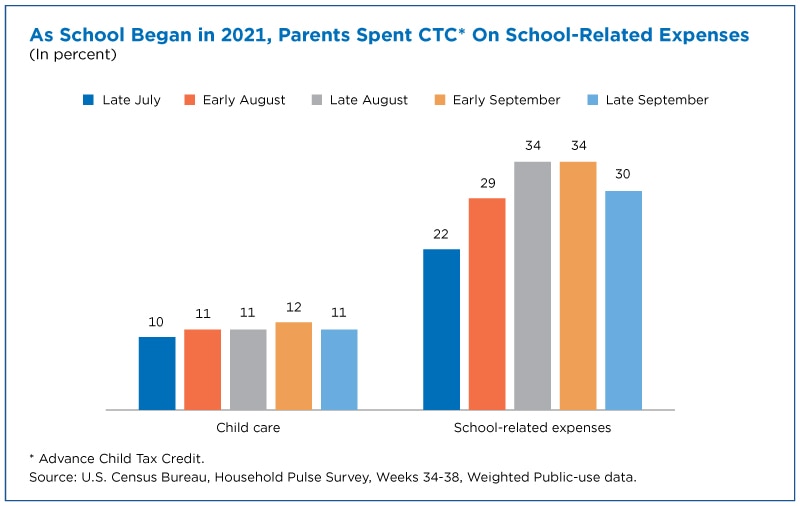

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

Child Tax Credit Will Monthly Payments Continue Into 2022

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

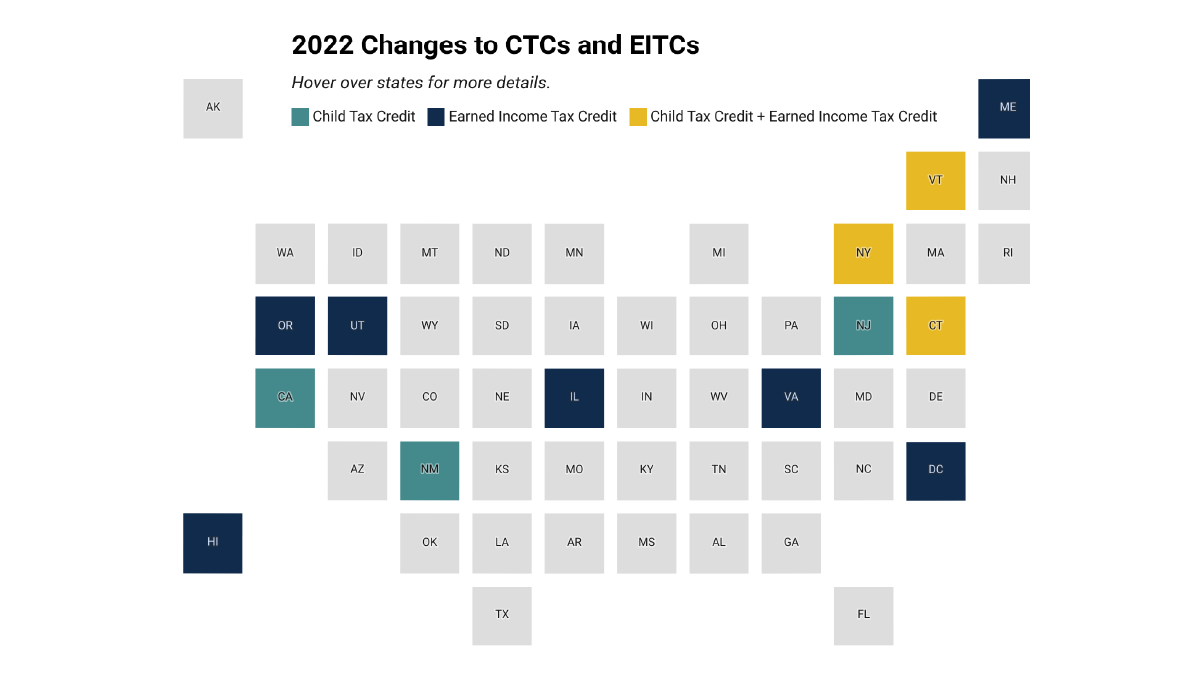

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Children 18 And Older Not Eligible Verifythis Com